What is Corporate Governance ?

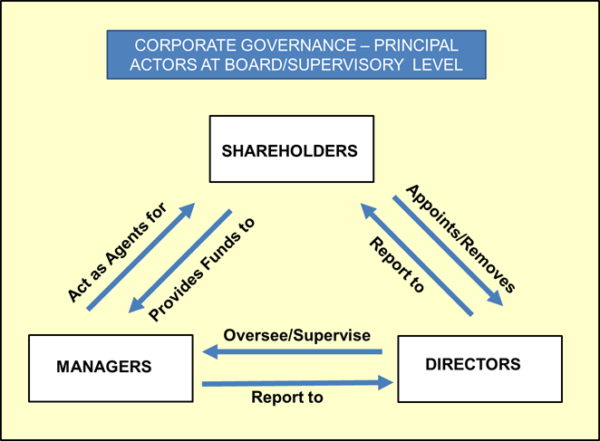

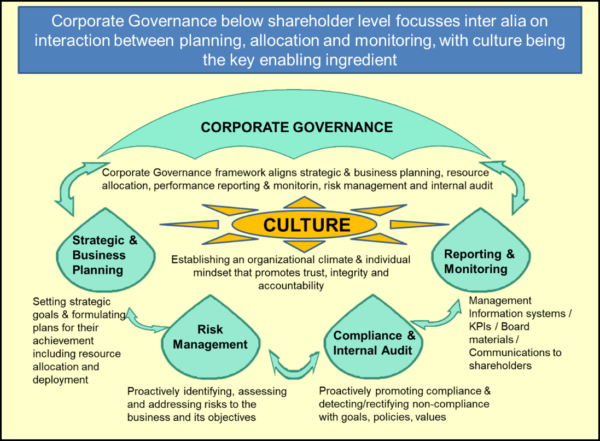

Corporate Governance pertains to structures, processes and culture for the direction and control of companies. It concerns the relationships among the management, the management oversight body (usually the Board of Directors, sometimes substituted or supplemented by a Supervisory Board), controlling shareholders, minority shareholders and other stakeholders.

Direction means ALL the decisions that relate to setting the overall strategic direction of the company including :

- Long term strategic decisions including large scale investment decisions

- Mergers and Acquisitions

- Succession planning and appointment of senior managers.

Control means ALL the actions necessary to oversee management’s performance and follow-up on the implementation of the strategic decisions already taken.

Why does it matter ?

Good Corporate Governance ensures a clear definition of the role, duties, rights and expectations of each of a firm’s governing bodies.

It follows that good Corporate Governance confers benefits to the business as it promotes conditions that are conducive to sustainable development of the business and improve its resilience to shocks and challenges, thus also enhancing its longevity. Absence or failures of Corporate Governance undermine a company’s resilience and can therefore increase the risks of business distress and failure.

Following high profile business attributed or linked to Corporate Governance failings or shortcomings, many countries have introduced mandatory Codes of Corporate Governance as a form of pre-emptive safeguarding. In many jurisdictions listed companies not only have to adhere to the relevant Code of Corporate Governance, they also have to report publicly on their compliance. Capital providers, such as banks and institutional investors are increasingly mindful of companies’ records on Corporate Governance and companies with poor records can find their access to capital is negatively affected. Conversely, companies with good records of Corporate Governance are rewarded by better market ratings.

How do you introduce Corporate Governance ?

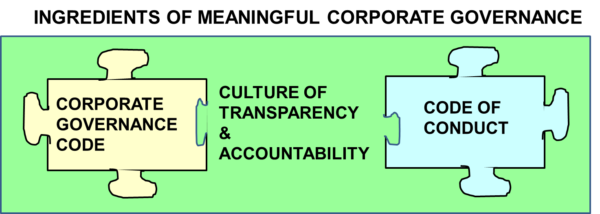

At a minimum a company, its owners, oversight body and management should aim for meeting the relevant prevailing Code of Corporate Governance in the country or countries where they are operating. But, whilst meeting at least such standards as all companies are expected to meet is necessary in order to mitigate the biggest risks from absence or failure of Corporate Governance, it is not sufficient in order to reap the full benefits from Corporate Governance. In order to do that, a company needs to go further and adopt best-in-class standards that may be beyond what others are prepared to do in this area. External advisors can assist in the benchmarking of where a company is and in setting the course of where it needs to get to. Ultimately, introducing Corporate Governance is about addressing each of the following :

- Formulating and adopting a Code of Corporate Governance

- Formulating and adopting a Code of Conduct

- Empowering and promoting a culture of transparency and accountability